Introduction #

The Bulk Payouts feature is designed to streamline the payout process for organizations, providing a solution that makes it easier to payout to multiple bank accounts and mobile wallets at the same time. This feature is great value for organizations that frequently payout funds to a different types of recipients, be it suppliers, employees, clients, or partners. Rather than processing payouts manually one by one, users can compile a batch file containing all transactions, upload this file, and complete all payout with a single click. Bulk payouts can only do payouts in TZS.

The bulk payouts feature has the following benefits for organizations:

- Time-Efficiency: Manual individual payouts can be labor-intensive. Our bulk payout feature automates this, allowing for batched payout, saving considerable time. With the capacity to execute up to 1,000 payouts simultaneously, efficiency is guaranteed.

- Scalability: As businesses expand, the volume of their payouts inevitably rises. Our system scales to accommodate this growth, ensuring timely payouts without added hassle.

- Error and Fraud Mitigation: Automated processes decrease the likelihood of manual entry errors and potential fraud.

- Enhanced Record-Keeping: A centralized system offers a more transparent audit trail, aligning businesses better with accounting and auditing standards. Make your accountant and auditor happy. Also there is the option to enhance each payout with a note to ensure clarity in financial communication and facilitate smoother reconciliation.

- Payout File Double Verification: We have two layers of verification when a payout file is imported, to make sure the payouts are accuracy and minimizing potential wrong payouts.

- Payout Notifications: Attach personalized messages to payouts, notifying recipients via email or SMS upon successful transactions.

- Hierarchical User Privileges: For larger organizations with complex payout processes we also offer two type of user levels: an ’employee’ tier for uploading payout without disbursement capabilities, and an ‘admin’ tier for both uploading payout and initiating payouts. This hierarchy ensures for better security and control in payout management.

This feature caters to a variety of organizations types such as:

- Manufacturers

- Agricultural firms

- Microfinances

- Vikobas

- NGOs

Within such organizations, individuals responsible for payroll, accounting, or financial management, think of owners, managers, accountants, bookkeepers, and administrators, will find value from this feature.

How to access and configure #

How to access #

To access the bulk payout feature, visit merchant.clickpesa.com, login with your account and navigate to the “Bulk Payout” menu item.

- On the page you should be able to see summary with bulk payouts count and value and all payouts associated to batches count.

- You will also be able to see a graph section where data are measured by time or status.

- On the graph you will be able to change graph data by selecting Time, value or status. You should also be able to change data style between area chart and bar chart

How to configure #

User Levels (optional)

An admin has the ability to setup additional users with two type of users levels. There is the option to create admin (upload and access funds) and employee (upload and no access to funds) user level. Refer to the team setting.

How to prepare payout file

To use this feature, you have to create a file with the payout details following the field format below. Each field has its own requirements. Download here our sample file, just remember to remove the example data and put in your payment details. You can add the payout data in the file on your computer using Excel (for Windows) or Numbers (for Apple). Once you are done, save or export this file as a CSV or Excel format on your computer ready to upload.

| Fields | Explanation | Example |

|---|---|---|

| Recipient Name | Name of the BANK ACCOUNT or MOBILE MONEY WALLET. | John Massawa |

| Receiving Channel | BANK or MOBILE MONEY | MOBILE MONEY |

| Receiving Channel Provider | BANK NAME or MOBILE MONEY PROVIDER NAME | TIGO PESA |

| Account Number | Mobile Money Number (format 12 digits including 255 and no 0) | 255789101219 |

| Amount | Mobile Money Minimum: 2,500 TZS Maximum: 5,000,000 TZS Bank ACH Minimum: 2,500 TZS Maximum: 20,000,000 TZS Bank RTGS Minimum: 11,900 TZS Maximum: 1,000,000,000.00 TZS | 100,000 |

| Transfer Type | Only applicable for Bank Transfer | ACH |

| Note To Recipient (optional) | Note to Recipient | This is the payout for gasoline usage 4 June 2023. |

| Recipient Contacts (optional) | Email or Phone Number (format 12 digits including 255 and no 0) | 255789101219 |

| Language (optional) | SWAHILI or ENGLISH (see Payout Notification Examples) | SWAHILI |

Note:

- ACH (EFT)

The payout is settled within 1 working day. Weekend days and holidays are not included. - RTGS (TISS)

The payout is settled within the same day. Weekend days and holidays are not included

If the bank account name is not correct, the payout will bounce, make sure you enter the correct account name.

These are the mobile money receiving channels we support, make sure to use this names mentioned in this list when creating your payout file.

| Mobile Money Provider Names |

|---|

| AIRTEL MONEY |

| EZY PESA |

| HALOPESA |

| MPESA |

| TIGO PESA |

This are the bank receiving channels we support, make sure to use this names mentioned in this list when creating your payout file.

| Bank Names |

|---|

| ABSA BANK TANZANIA LIMITED |

| AKIBA COMMERCIAL BANK PLC |

| AMANA BANK LIMITED |

| BANCABC TANZANIA LIMITED |

| BANK OF AFRICA TANZANIA LIMITED |

| BANK OF BARODA TANZANIA LIMITED |

| BANK OF INDIA TANZANIA LIMITED |

| CANARA BANK TANZANIA LIMITED |

| CHINA DASHENG BANK LIMITED |

| CITIBANK TANZANIA LIMITED |

| CRDB BANK PLC |

| DCB COMMERCIAL BANK PLC |

| DTB TANZANIA PUBLIC LIMITED COMPANY |

| ECOBANK TANZANIA LIMITED |

| EQUITY BANK TANZANIA LIMITED |

| EXIM BANK TANZANIA LIMITED |

| GT BANK TANZANIA LIMITED |

| HABIB AFRICAN BANK LIMITED |

| I&M BANK TANZANIA LIMITED |

| INTERNATIONAL COMMERCIAL BANK TANZANIA LTD |

| KCB BANK TANZANIA LIMITED |

| MKOMBOZI COMMERCIAL BANK PLC |

| MWALIMU COMMERCIAL BANK PLC |

| MWANGA HAKIKA BANK LTD |

| NBC LIMITED |

| NCBA BANK TANZANIA LIMITED |

| NMB BANK PLC |

| PEOPLES BANK OF ZANZIBAR LIMITED |

| STANBIC BANK TANZANIA LTD |

| STANDARD CHARTERED BANK TANZANIA LTD |

| TANZANIA COMMERCIAL BANK PLC |

| UBA TANZANIA LIMITED |

Notifications #

Notifications are sent to beneficiary when payout is initiated using merchant default language which can be set here.

Once payout is successfully initiated to beneficiary you will receive notification in your merchant dashboard and email.

If payout fails for any reason and is refunded or reversed you will receive notification via your merchant dashboard and email. Learn more about notifications here. If payout was created with customer contact details, they will also receive notification when payout is reversed.

Fees and fee configurations #

Fee bearer #

You can set up who is the fee bearer between you and recipient or both on Payout Settings.

What will this mean on the payouts?

- If fee is on you, the fee will be added on top of the amount you’ve entered and the recipient will receive the exact amount you provided (You will be charged the whole fee)

- If fee is on beneficiary, The fee will be deducted from the amount you’ve entered and the recipient will receive amount minus fee (Recipient will be charged the whole fee)

- If fee is on both, Half of the fee will be added on top of the amount you’ve entered (you will be charged half of the fee). Recipient will receive Amount minus half of the fee (recipient will be charged half of the fee).

Click here to learn more about how we charge fees

Free GTBank Transfer #

- When paying out to customer using GTBank, its free of charge, fee will be 0

How to use bulk payout #

- Create new batch payout

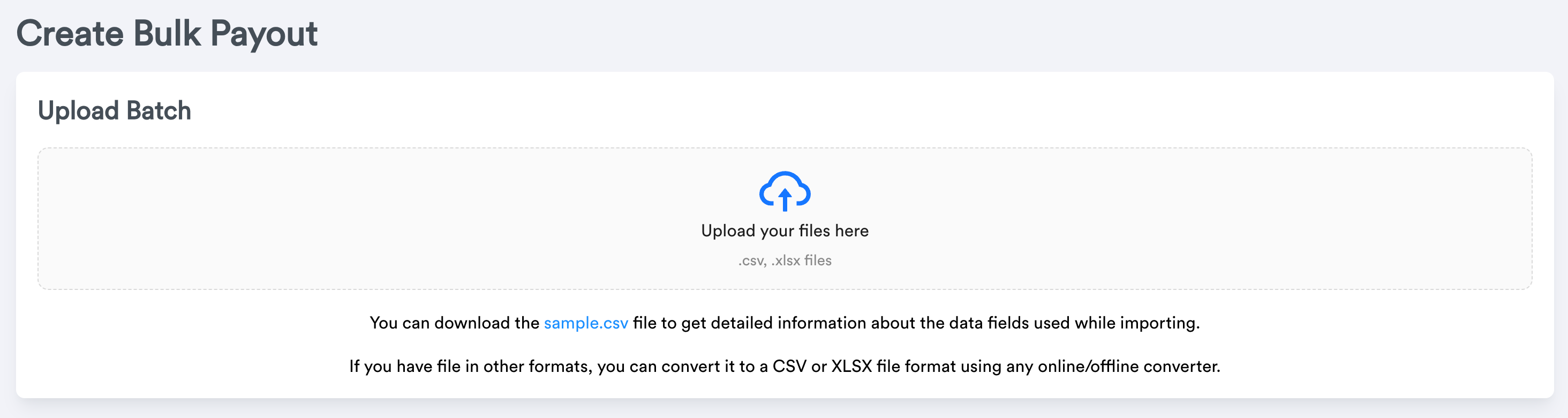

To create a bulk payout click the “Create New Batch” button. - Upload payout file

You will be taken to the Create Bulk Payout page, on this page you can click on the “Upload your file here” section. This will prompted to select a file, go to the correct folder on your computer where you saved the payout file, select the payout file and upload the payout file. Find explanation here how to prepare your payout file.

- Verification: Field Match

The first verification step ensure that columns in your payout file (called Incoming Fields) match our system’s columns (Destination Fields). If your column names are different or slightly off, our system may not understand them. This step lets you fix any mismatches. Check the preview of your data to make sure everything lines up. Once it looks correct, click the “continue” button. - Verification: Data Check

The second verification step, ensure that your payout file’s data is accurate and formatted correctly. If something is off, like the receiving channels are named correctly as per this overview, the row highlights red. To fix it, click the pencil icon beside the row. After making corrections in the correct manner, the row turns green; click the save icon then. If there are issues with the minimum or maximum amount, adjust those too. When all rows are green, you will see the total amount on top, including fees, for the payout. - Balance: Top-up and Payout

Once the payout is green, based on your balance, you have two choices:- Save Draft and Top-up (Ignore when enough balance) If your balance is not sufficient for the payout, the “Confirm and Payout” button will be disabled. In addition a message will display showing your current balance and the exact amount you are short for doing the batch payout. To address this, click on the top-up option in the highlighted message to do a top-up.

It opens a drawer, in that drawer select the bank deposit option.

Instruction on how to top up using bank will be provided and you can use these instructions to top up your balance, once your deposit is done you can click on the “Done” button.

- Confirm and Payout (Enough balance) When there is enough balance funds to do the batch payout click on the button “Confirm and Payout”. The status of the batch payout and transaction will change to “processing” and the payout will happen accordingly by end of the day.

- OTP will be sent to your registered phone number and you will be prompted with OTP field for security check before confirming the batch.

- Once payouts are successful initiated you will receive notification via email or your dashboard.

- Ability to verify mobile account names before paying out

When paying out to mobile, you will be able verify account names. After uploading your batch, you will find a verify button under account number on Mobile payouts which when clicked it will return account name which you will be able to compare with the name you submitted.

This is important feature as it helps reduce human errors especially when you enter a wrong number.

Note: Its currently supported only on TIGOPESA and AIRTELMONEY Mobile Payouts Only

- Save Draft and Top-up (Ignore when enough balance) If your balance is not sufficient for the payout, the “Confirm and Payout” button will be disabled. In addition a message will display showing your current balance and the exact amount you are short for doing the batch payout. To address this, click on the top-up option in the highlighted message to do a top-up.

- View Single Batch

This page contains information about a single payout such as status, total amount and fees. It also includes all payout transaction of that particular batch. - View All Batches

This page contains an overview of all the generated batches.

Common Use Cases #

- Example of a Manufacturing Company using the bulk payouts feature

“We are a 24 employees manufacturing business located just outside the city. We deal with many outgoing transaction on weekly basis. Our banking branch is in the city. We still pay out our staff manually because our bank does not support mobile money. We asked the MNOs for a bulk payment solution last year but that was time consuming. The bulk payout feature covers both, it sends funds to bank account and mobile wallets. It also enables us to stay in our office and use a good portal“ - Example of a Microfinance Company using the bulk payouts feature

“We have a bank account setup that we use to disburse a loan to another bank account or mobile wallet. We use to attach all transactions in those bank accounts manually to the right customer and loan within our loan management system, which took a lot of time and it is hard to keep an overview. With the bulk payout feature this happens automatically and in a controlled manner”

Frequently Asked Questions (FAQ) #

- What if the available funds in my balance are not enough?

If the balance is not sufficient, the “Confirm and Payout” button is disabled. You will be given provided with a message that shows your current balance and the balance you are short. You need to top-up your balance using the bank deposit option, once bank transfer is received the new balance will reflect and you are ready to complete the bulk payout. - How long does it take before the deposit appear in my balance once I have done the bank transfer?

When a bank transfer is done to top-up your balance, it takes a maximum of 24 hours to reflect in your balance. - What if the recipient bank name or bank number is incorrect and I already sent out the funds? When payout details are incorrect the payout will bounce and the funds will be returned to your balance. Do note this takes a couple of days, therefore always make sure that the payout details such as recipient bank or mobile money wallet name and recipient bank and mobile money wallet number are correct and match

- What if the recipient mobile money wallet name or mobile money wallet number is incorrect and I already sent out the funds?

When payout details are incorrect the payout will bounce and the funds will be returned to your balance. Do note this takes a couple of days, therefor always make sure that the payout details such as recipient bank or mobile money wallet name and recipient bank and mobile money wallet number are correct and match. - Shall my organization have an account as an user or should our customers have this?

Your organization requires an account under ClickPesa to use bulk payouts, your recipients or customer do not need a ClickPesa account. ClickPesa disburses to all existing bank accounts and mobile money wallets and not to other ClickPesa accounts. - Can the payment made via ClickPesa be used as evidence of payment in case of a dispute, let’s say someone denies receiving the payment form?

Yes, the transaction records can be used as evidence. - We have a bank account with CRDB, and we want to disburse a funds to a recipeint, the command to make a disbursement, is that done through the CRDB or does ClickPesa just track the record of that transaction?

The funds have to be send from your bank account to your balance within your ClickPesa account by doing a top-up. The disbursement than takes place within your ClickPesa account whereby your balance in your ClickPesa account is used to payout to the recipients specified bank accounts or mobile wallets. - Does this work with other systems?

Yes, users can contact ClickPesa for integration possibilities. - How much per transaction are you charging?

Transaction charges are not provided in the explanation. Users should consult ClickPesa’s fee structure or contact their support for detailed information. - How do the funds move during disbursement from our organization bank accounts to customers’ accounts?

The funds have to be send from your bank account to your balance within your ClickPesa account by doing a top-up. The disbursement than takes place within your ClickPesa account whereby your balance in your ClickPesa account is used to payout to the recipients specified bank accounts or mobile wallets. - How is the process in case they make a wrong payment?

When payout details are incorrect the payout will bounce and the funds will be returned to your balance. Do note this takes a couple of days, therefore always make sure that the payout details such as recipient bank or mobile money wallet name and recipient bank and mobile money wallet number are correct and match. - When bulk payment is confirmed, the transaction’s status is PROCESSING, do receivers receive any notification that the transfer was initiated to keep track of the initiation time?

No, the recipient only received a notification when the funds are received in their bank account or mobile wallet. - When a transaction is FAILED, how does a receiver know that the transaction has failed?

You are informed via your ClickPesa account that a transaction failed and you have to inform the receiver accordingly. - By using ClickPesa can I be able to see the amount I disbursed and to who?

Yes, users can view detail under “View All Batches” and “View Single Batch”, including amounts and recipients. Also each payout appears under transaction, whereby there is the option to export data. - Can ClickPesa be able to top up my account, in case I need to disburse to someone and I do not have enough balance? ie. like Songesha does.?

ClickPesa does not automatically top-up like “Songesha”. You have to make sure your balance is sufficient using the “Top-up” option. - What happens in case I make a mistake and pay to the wrong number using ClickPesa?

When payout details are incorrect the payout will bounce and the funds will be returned to your balance. Do note this takes a couple of days, therefore always make sure that the payout details such as recipient bank or mobile money wallet name and recipient bank and mobile money wallet number are correct and match. - Do my customers require to use ClickPesa as well when using ClickPesa to do disbursement? Your customers do not need a ClickPesa account as ClickPesa is a not wallet. We payout to existing bank accounts and mobile money wallets.