A significant portion of a business’s cash flow is tied up in invoices, also known as accounts receivable, creating pressure on accountants or finance teams. Managing invoices and chasing late payments can be both time-consuming and costly. Digital invoicing provides a solution to reduce outstanding invoices and improve cash flow while keeping processes streamlined. Here’s how it can help Tanzanian businesses effectively manage their invoicing.

1. Keep Invoices and Records Organized

The first step in reducing outstanding invoices is to maintain a clear record of what has been invoiced, paid, or remains outstanding. This process becomes much easier with digital invoicing software, which:

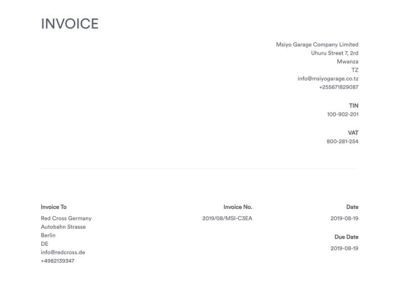

- Automatically provides standard invoice templates.

- Tracks due dates and sends automated reminders for payments.

- Matches incoming payments to invoice numbers to identify paid and unpaid invoices.

If your current invoicing software doesn’t automate these processes, consider switching to one that does or setting up manual processes to ensure accurate tracking.

When creating invoices, include detailed and accurate information:

- Clearly describe the service or product provided.

- Set a correct due date.

- Ensure the customer’s and your own business details are accurate.

Additionally, maintain records that back up the invoice, such as agreements or other documentation, to handle disputes effectively.

2. Offer Discounts and Charge Late Fees

Encourage timely payments by offering small discounts for early payments and charging penalties for late payments. For example:

- A percentage discount if the invoice is paid within a specific timeframe.

- A flat fee or percentage of the total as a late penalty after the due date.

Digital invoicing software makes it easy to include and communicate these terms directly on the invoice, reducing misunderstandings and disputes.

3. Follow Up Regularly

While most customers intend to pay on time, reminders can ensure they do. A proactive follow-up strategy significantly reduces payment delays. For example:

- Send a reminder a week before the due date via email, SMS, or WhatsApp.

- Attach the original invoice in case it was misplaced.

- If the customer still doesn’t respond, follow up with a phone call or in-person visit.

During follow-ups, maintain a professional tone but stress the urgency of payment. If a customer is facing financial difficulties, consider offering a payment plan to ensure at least partial recovery of the invoice amount.

4. Handle Outstanding Invoices

Despite your best efforts, some invoices may still go unpaid. In these cases, consider the following steps:

Debt Collection

Hiring a debt collector may be an option, but weigh these factors first:

- Is the invoice amount large enough to justify the collection cost?

- Can the customer pay, or are they facing financial difficulties?

- Is the customer traceable, especially in the case of individuals?

Write Off Bad Debts

When recovery is impossible, write off the unpaid invoice as a bad debt. In Tanzania, the Income Tax Act allows non-financial institutions to claim a tax deduction for bad debts if:

- The debt was previously included in taxable income calculations.

- It is written off as irrecoverable in the company’s books during the same income year.

- Reasonable steps to recover the debt were taken, with evidence provided for tax audit purposes.

Bad debts can be managed using two methods:

- Direct Write-Off Method: The uncollectible amount is removed from the debtors’ list and recorded as an expense.

- Allowance Method: Estimate a portion of debts that may become uncollectible and record it as an allowance for bad debts.

For tax purposes in Tanzania, the direct write-off method is more commonly accepted.

Benefits of Digital Invoicing

Digital invoicing doesn’t just help with outstanding invoices; it offers a range of advantages:

- Time Savings: Automates tasks like sending reminders and matching payments to invoices.

- Cost Reduction: Reduces administrative burden and eliminates paper costs.

- Improved Accuracy: Minimizes errors through automated tracking and reminders.

- Transparency: Provides a clear overview of all invoices and their statuses.

- Professional Appearance: Ensures invoices are clear, detailed, and well-structured, enhancing your reputation with clients.

Conclusion

Managing invoices effectively is critical for maintaining cash flow and ensuring business success in Tanzania. Digital invoicing streamlines the invoicing process, saves time, and improves payment collection. While it cannot guarantee 100% recovery of all invoices, it significantly reduces the risk of late or unpaid invoices by keeping records organized, automating reminders, and offering professional templates.

For businesses in Tanzania, the adoption of digital invoicing is no longer optional—it’s a necessity to stay competitive and manage resources efficiently.

Chris Low, former Group CEO at Letshego Group, joins ClickPesa’s advisory team

Chris Low, former Group CEO at Letshego Group, joins ClickPesa’s advisory team

Leave a Reply

You must be logged in to post a comment.