Paying someone via mobile money is straightforward, most organizations have access to mobile wallets, bank accounts, or nearby mobile money agents for deposits. While making one outgoing payment is simple, managing a high volume of payments can quickly become a complex and error-prone task without an efficient system in place.

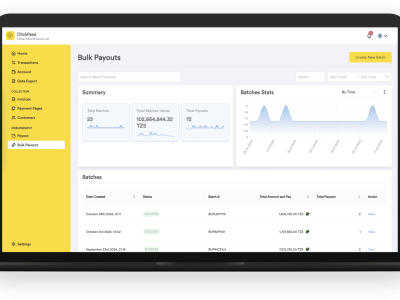

ClickPesa offers a streamlined mobile money bulk payout solution, helping businesses manage large-scale payments effortlessly while reducing time and errors.

What Are Mobile Money Bulk Payments?

Mobile money bulk payouts, also known as mass payments, batch payments, or bulk payouts, refer to processing multiple mobile money payments from a single account to a predefined list of beneficiaries at the same time.

Imagine managing hundreds of payments every month or regularly making the same set of payments. Processing each payment individually would be time-consuming and inefficient. Bulk payments simplify this by consolidating payments into a single process, requiring only the preparation of a beneficiary list.

Setting Up a Beneficiary File

To initiate mobile money bulk payout, a pre-specified beneficiary list must be created. This list includes essential details for each recipient, typically organized with:

- Rows: Representing individual beneficiaries.

- Columns: Containing details like the beneficiary’s name, payment amount, mobile money wallet type, and an optional internal note for reconciliation.

The internal note can be linked to your accounting system, ensuring seamless tracking and reconciliation of payments.

Real-Time Tracking

Modern mobile money bulk payout systems often include real-time tracking capabilities, accessible through banking portals or mobile network operator (MNO) platforms. Tracking features may vary by country, but they enable businesses to monitor payment statuses, ensuring transparency and efficiency.

Export Data

Exporting data with ClickPesa is seamless and intuitive, designed to simplify your financial reporting and analysis. With just a few clicks, you can export detailed payment data, including transaction histories, beneficiary details, and reconciliation records, in widely used formats like CSV or Excel. This feature ensures that businesses can easily integrate ClickPesa data into their existing accounting systems or share it with stakeholders for transparent reporting. Whether for auditing, compliance, or performance tracking, ClickPesa’s export functionality makes managing your financial data straightforward and hassle-free.

Who can be paid using Mobile Money Bulk Payouts?

Bulk payments can accommodate any beneficiary with a valid account, making them ideal for:

- Loan disbursements

- Insurance claim settlements

- Employee payroll

- Promotional payments

- Supplier payments

- Project fund disbursements

- Dividend payments

- Rent payments

How to set up a Mobile Money Bulk Payout System

Mobile money bulk payout systems are typically provided through online banking portals or MNO platforms. However, integrating bulk payments with your internal systems offers additional efficiency.

ClickPesa provides a robust solution that integrates directly with your existing accounting system, reducing the reconciliation load and streamlining payment processes. Our platform ensures that businesses can automate and manage bulk payments with ease, saving time and minimizing errors.

Why choose ClickPesa for Mobile Money Bulk Payouts?

ClickPesa’s mobile money bulk payout solution simplifies large-scale payment processes, enabling businesses to focus on growth while ensuring accurate, timely payouts. With features like automated reconciliation, real-time tracking, and seamless integration, our platform is designed to meet the demands of modern organizations.

Discover the benefits of ClickPesa’s integrated mobile money bulk Payouts solution for your business. Simplify your payment workflows today and unlock greater efficiency.

Managing invoices effectively with digital invoicing in Tanzania

Managing invoices effectively with digital invoicing in Tanzania

Leave a Reply

You must be logged in to post a comment.