Rick Groothuizen of ClickPesa outlines the status of financial digitalization in East Africa and the progress that has been made in this emerging market. This post was originally posted in the Paypers.

Mobile money refers to digital cash and enables people to do digital payments. The East African region, with countries such as Tanzania, Uganda, Kenya and Rwanda, leads the world in the highest per capita registered and active mobile money accounts, volume of mobile money transactions and agent network. The region has the fastest growth in mobile money accounts and in each country the number of accounts surpassed the number of bank accounts.

Whereas payments by mobile phone have only emerged in the Western world since the last couple of years, the phenomenon is ongoing in the East African region since 2007. The roots of mobile money lay in Kenya with the launch of M-Pesa by Vodacom . With the lack of financial infrastructure in the region and the cost of mobile phones dropping rapidly in that same period, it spread quickly through the rest of East Africa.

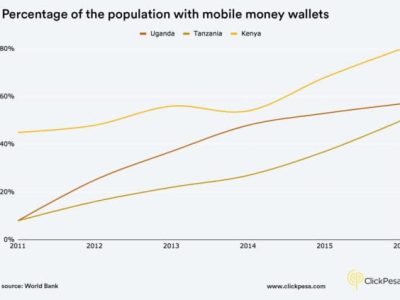

Mobile money has literally changed the lives of millions in East Africa in the last 12 years. In Uganda, according to FinScope, the population using mobile money grew from 7% in 2009 to 34% in 2013. In Tanzania, for the same period of time, the percentage grew from 17.3% to 39.8%. Kenya experienced even larger growth percentages.

The next phase is to go beyond the initial success to further reduce the number of unbanked people and meet the demand for other underdeveloped financial services in the East African region. Below are three key areas outlined playing an important role in the next phase.

1. Payment interoperability in East Africa

According to CGAP, regional trade between East African countries is a substantial contributor to the economy. Over the last decade, wallet providers have been making substantial progress in enabling users to do mobile money payments between East African countries. Although cross border payments are seamless, high transaction cost remains a challenge, and research has shown that this creates a barrier for users using mobile money across borders. New financial infrastructure technology such as Mojaloop, Ripple and Stellar could lower the cost of doing cross-border payments in the region and drive digital payments across borders.

2. SMEs financial services

Although it caused a revolution in the East African region and digitized payments for consumers, it has not revolutionized and digitized payments for businesses, in particular, not for SMEs. A large part of the SMEs still uses physical cash due to the fact that digital financial services are fragmented, costly and overcomplicated.

Domestically, cheque payments are still a common form for business payments, while holding accounts under a bank is expensive for SMEs due to monthly fees. Mobile money accounts are often used but mixed up with personal accounts, making accounting and reconciliation difficult. Internationally, with the growing globalization and the recent African Continental Free Trade Agreement (AfCFTA) , SMEs…

Read full article on the Paypers

Alternative for PayPal in Tanzania

Alternative for PayPal in Tanzania

Leave a Reply

You must be logged in to post a comment.