By: Imani Alfayo: Published in Medium

The banking sector in Tanzania has been stressed over the past couple of years, the implications were visible in 2018 with over 5 banks having their banking licenses revoked due to under-capitalization and eventually shutting down. It has also been observed that bank profits are dwindling, different banks are employing different strategies in an effort to turn their ships around.

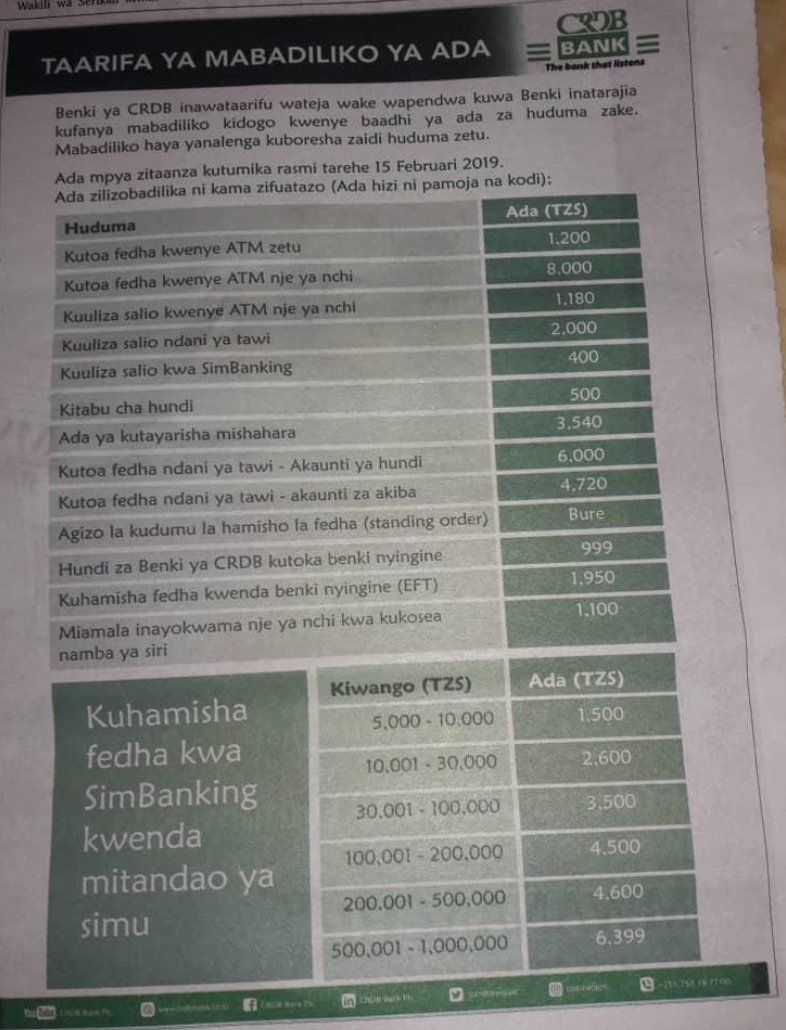

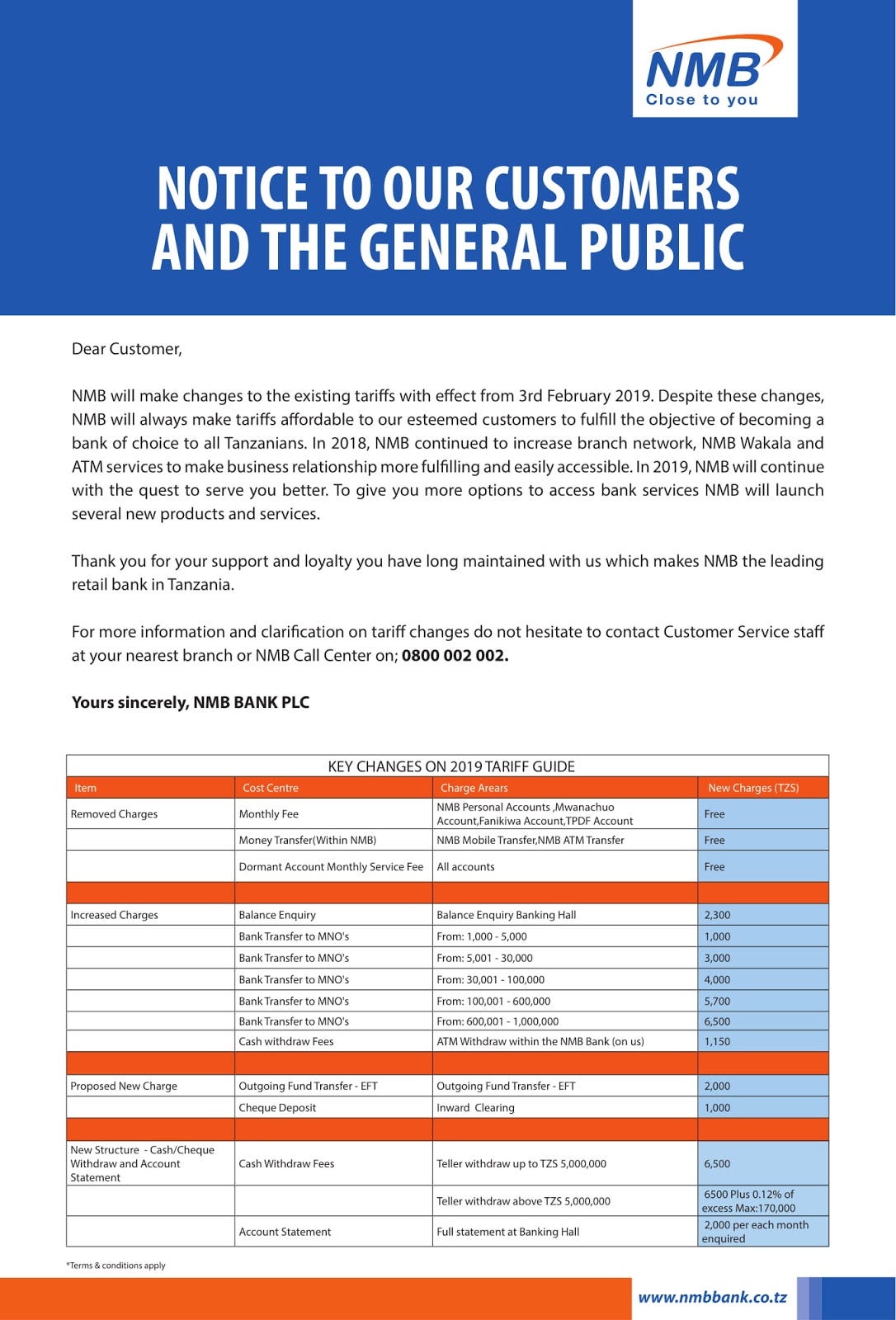

In mid January, two of the biggest banks by customer base and branch network CRDB Bank Plc and NMB Bank Plc revised their tariffs upwards. Noticeable was nearly a 50% increase in some of the banking fees, levies and commissions they charged.

Customers Reaction.

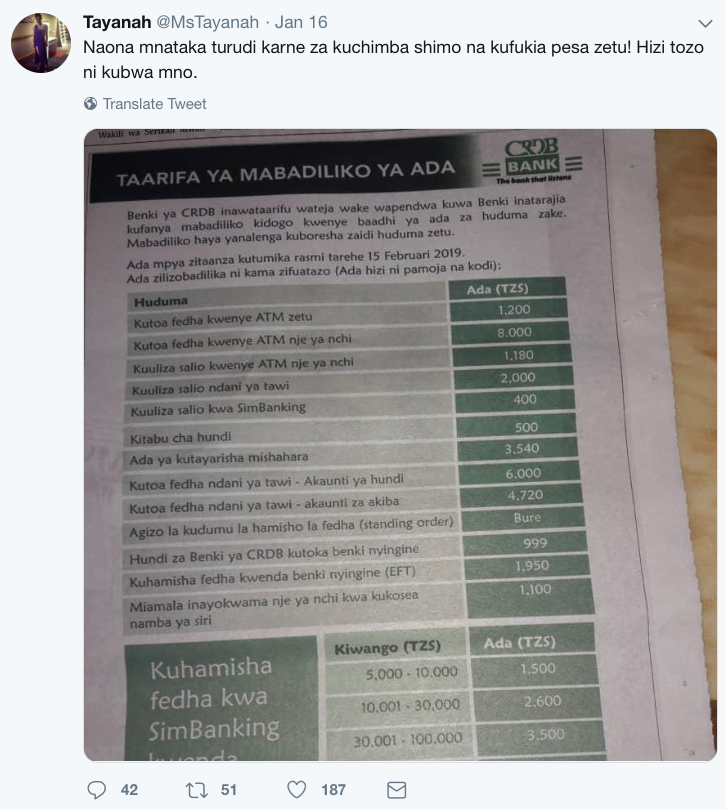

Customers did not react well to this and shared their sentiment online, you can tell by some of the responses to this tweet .

Translation “I see you want us to go back to the days of digging holes and burying our money. These charges are too high”

PR Intervention

In an effort to mitigate the harshness from the online community, one of the oldest tactics in the book was put to play — enticing customers by telling them that their accounts do not incur fees, a move I find unethical, but then again the principles of banking have never been ethical to start with.

NMB went first and CRDB followed suit shortly after.