At ClickPesa, our payment gateway’s disbursement service is designed to streamline and enhance the financial processes for businesses in Tanzania. The service is convenient when you do every month large numbers of staff, vendors, contractors, suppliers and government institutions payouts. By compiling them all into a batch you can now payout all these payments at once to any mobile money wallet or bank account.

Payout Channels

The payment gateway supports disbursement to

Mobile Money Wallets

Banks

And all other banks in Tanzania

Payout Tools

The gateway supports disbursement via the following tools

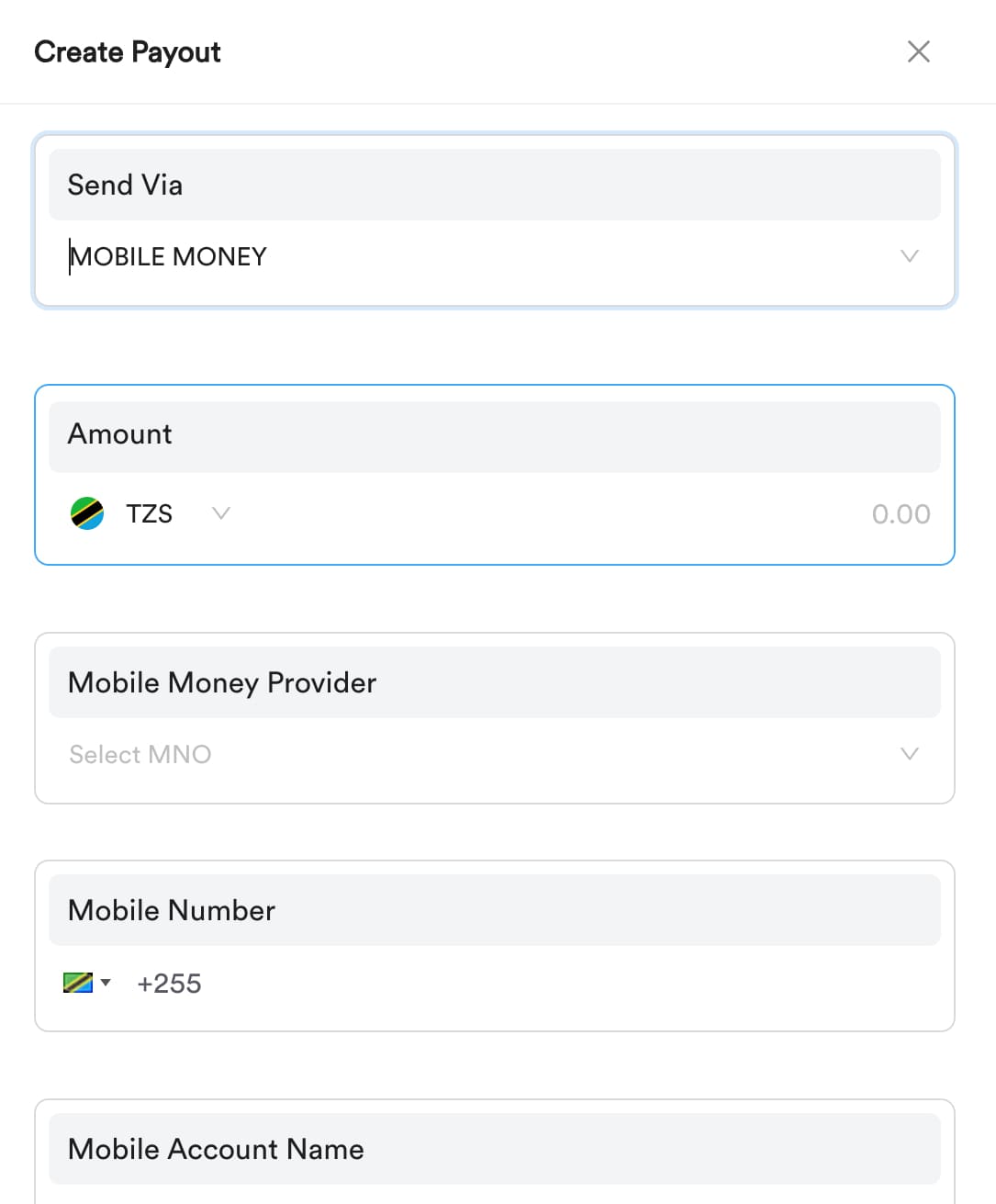

Single Payout

Payment Tracking It allows you to keep track of successful or failed payouts.

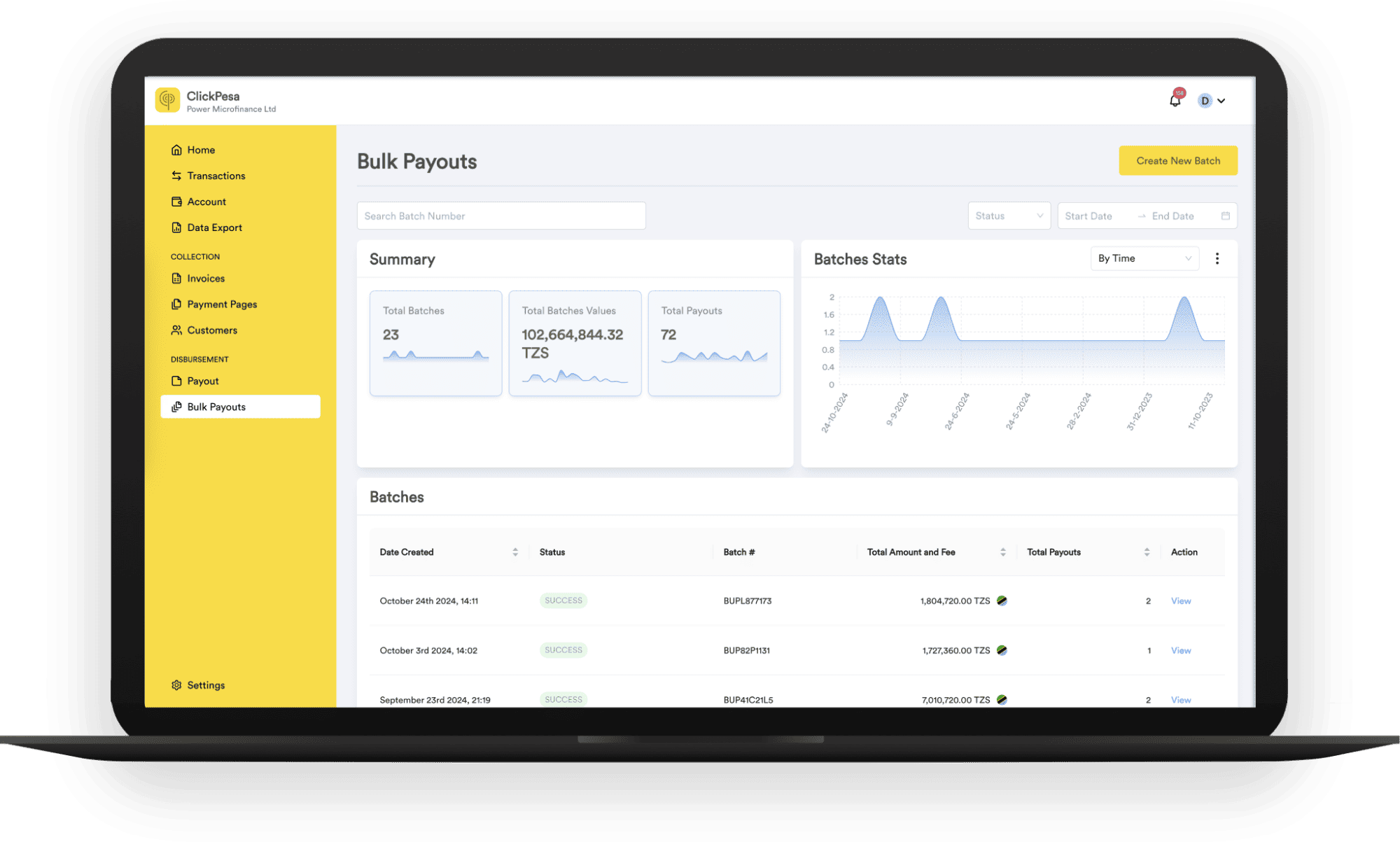

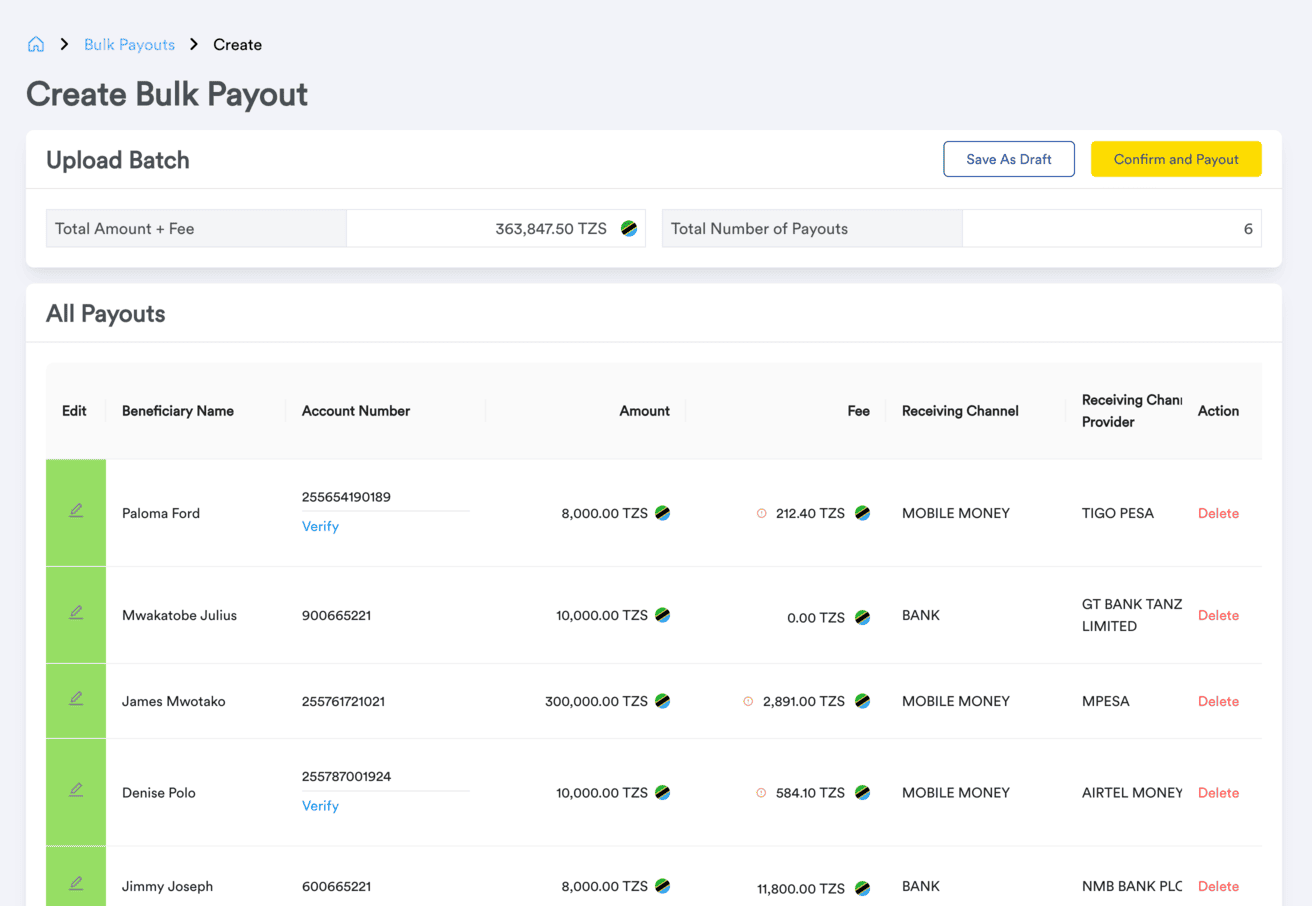

Bulk Payout

Organizations can initiate bulk payments for a mass payout, sending batch payments all at once. Payment Tracking It allows you to keep track of successful or failed payouts. Single Upload. Uploading an Excel or CSV file with all payments that need to be made.

Access to Payout Channels and Tools

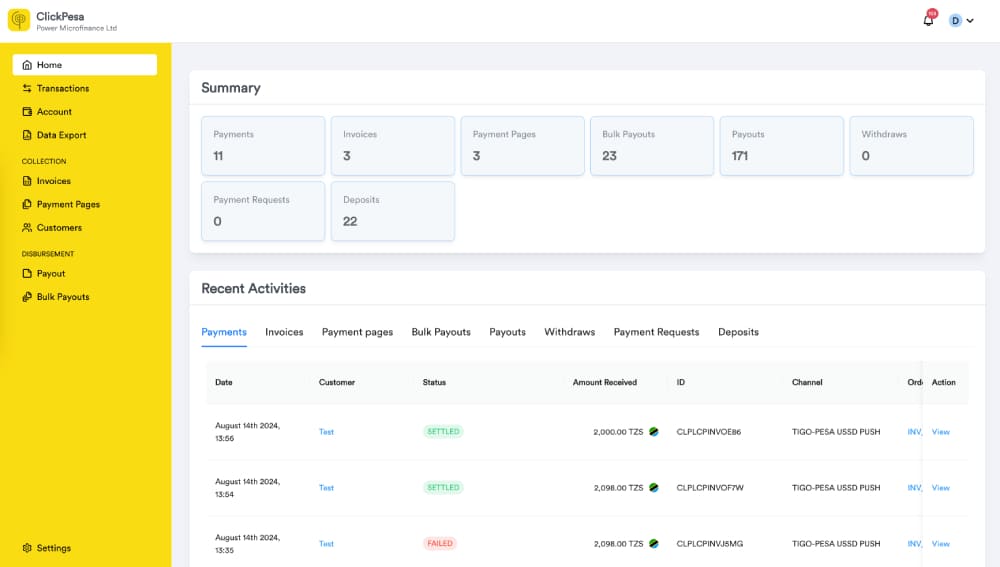

Web-based Merchant Dashboard

Web-based Merchant App, a dashboard whereby you can create checkout links, payment pages, invoices and payment references as well as do single and bulk payout through an upload. In addition we provide user levels and give the ability to export transaction data is Excel or CSV to keep your administration easily updated.

- Create checkout links, payment pages, invoices, payment reference and do (bulk) disbursement

- User levels: Manager and Employee

- Export Transactions in CSV, Excel for Quickbooks, Xero and other (accounting) software.

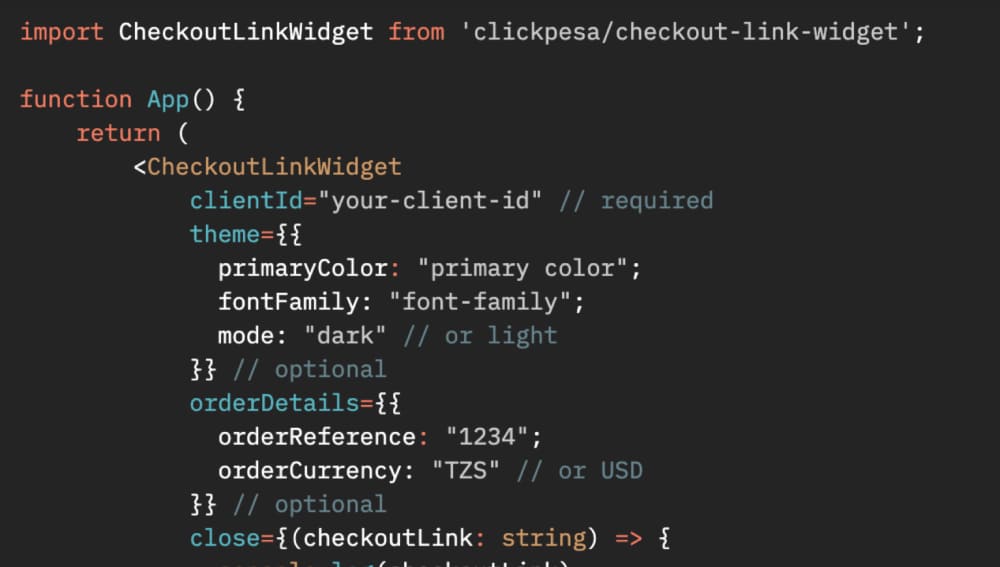

API Integration

APIs, enabling your development team to integrate and automate the collection of payments, the disbursement of payouts and the transaction data with your (accounting) software solution.

- Collection

- Disbursement

- Transaction Data

Convenience at ease

Single account for all payments

With ClickPesa, merchants no longer have to open multiple accounts to accept payments from different e-payment channels.

Deposit for payouts from any bank and mobile money account

Accept any form of digital deposit to make payouts.

Keep track of payment data for easy reconcilation

Convenient overview to track all your transactions.