Invest in ClickPesa

ClickPesa is planning a seed investment round this year. We are a UK based fintech with presence in the fast growing financial services industry of the East African market. If you are interested in investing and becoming an owner in ClickPesa, register your interest through the form below. Registering your interest doesn’t cost anything and you don’t (financially) commit anything.

SMEs in emerging markets have unmet needs and face pain points in handling digital payments

35% of SMEs report high processing costs as a major challenge with traditional payment methods.

Opening bank accounts requires a lot of paperwork.

Reconciling multiple invoices and receiving and processing payments data can be cumbersome due to lack of back-office support for payments.

30% of SMEs quote payment processing time as a major issue.

Lack of ability to track payments from end to end, preventing real-time audit trails for reporting.

Mobile Network Operations (MNOs) don’t support multiple currency wallets

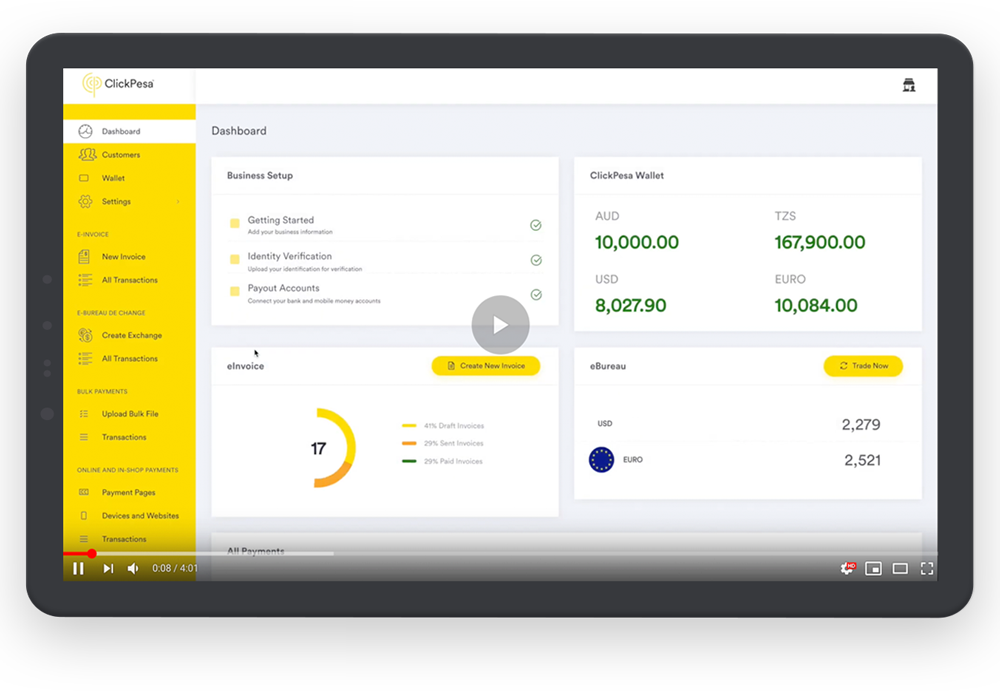

Invest in ClickPesa, which solves these problems by providing a platform that combines needed business tools with digital payments services

ClickPesa offers tools that allow small and medium business owners in emerging markets to receive and make digital payments more easily. This is crucial in supporting trade and economic growth across Africa and other emerging markets more broadly.

ClickPesa was started because we noticed that if we are able to remove the challenges and complexities in transactions, significant value can be unlocked to SMEs. Through extensive conversations with SMEs and entrepreneurs, we gained the right knowledge to create unique solutions that help SMEs and entrepreneurs perform better by increasing productivity and lowering cost.

As featured in